From Abba Dukawa, Abuja

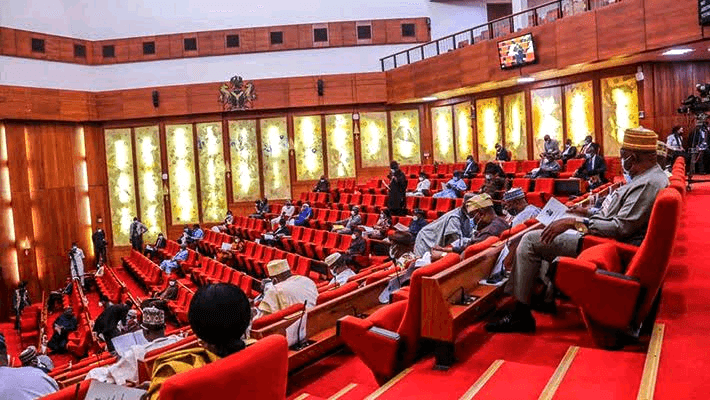

The Senate has approved President Bola Tinubu’s request for a ₦1.77 trillion ($2.2 billion) loan after a voice vote in favor of the proposal.

Presiding over the session, Deputy Senate President Barau Jibrin, alongside the Senate Committee on Local and Foreign Debts—chaired by Senator Wammako Magatarkada (APC, Sokoto North)—presented the committee’s report, which led to the approval.

The loan request, submitted by President Tinubu on Tuesday, forms part of a broader external borrowing plan aimed at partially financing the N9.7 trillion budget deficit for the 2024 fiscal year.

In his letter to the National Assembly, Tinubu sought approval for the ₦1.767 trillion loan (equivalent to $2.209 billion) as part of the 2024 Appropriation Act.

This fresh loan will add to the Federal Government’s growing debt servicing obligations. The Central Bank of Nigeria (CBN) recently reported that servicing foreign debt in the first nine months of 2024 cost the government $3.58 billion.

According to the CBN’s international payment statistics, this represents a 39.77% increase from the $2.56 billion spent during the same period in 2023.

The CBN report highlights the rising burden of Nigeria’s debt obligations. Notably, the highest monthly foreign debt servicing cost in 2024 occurred in May, amounting to $854.37 million. In comparison, the highest monthly payment in 2023 was recorded in July at $641.70 million.

A breakdown of international debt servicing costs reveals notable trends in payments over the year:

January 2024 saw a staggering 398.89% surge, with debt servicing costs skyrocketing to $560.52 million from $112.35 million in January 2023.

However, February 2024 recorded a slight decline of 1.84%, with payments dipping from $288.54 million in 2023 to $283.22 million.

Subsequently, March 2024 experienced a significant 31.04% decrease, with payments falling to $276.17 million from $400.47 million in 2023.

Then, April 2024 witnessed a dramatic 131.77% increase, with debt servicing costs soaring to $215.20 million, up from $92.85 million in 2023.

Moreover, May 2024 saw the highest monthly payment at $854.37 million, reflecting a substantial 286.52% increase from $221.05 million in May 2023.

Conversely, June 2024 experienced a slight decline of 6.51%, with payments totaling $50.82 million, down from $54.36 million in 2023.

Similarly, July 2024 recorded a moderate 15.48% reduction, with debt servicing falling to $542.50 million from $641.70 million in July 2023.

Likewise, August 2024 also showed a decline of 9.69%, with payments totaling $279.95 million, compared to $309.96 million in the previous year.

Finally, September 2024 marked a significant 17.49% increase, with payments rising to $515.81 million from $439.06 million in September 2023.

The rising debt servicing costs highlight the increasing strain on Nigeria’s finances, underscoring the urgency of managing the nation’s debt levels as it navigates its economic challenges.