From Muawuya Bala Idris, Katsina

The Katsina State Government has organised a training programme on Revenue Management and Digital Payment Systems as part of efforts to strengthen transparency and block leakages in public finance.

Participants at the training include revenue officers, financial controllers, and cashiers from various ministries and departments. The programme was organised and facilitated by the Office of the Technical Adviser on Treasury Single Account (TSA).

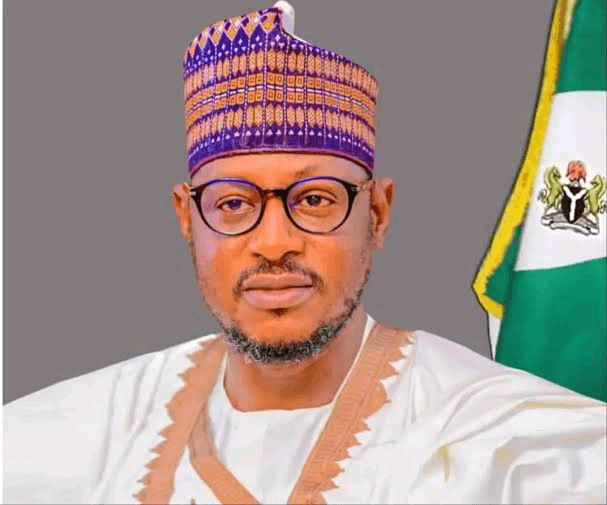

Speaking during the event, the State Technical Adviser on TSA Implementation, Dr. Salisu Ladan, said the training aligns with Governor Dikko Umaru Radda’s commitment to transparency, accountability, and modernising public finance through digital reforms.

“This training focuses on revenue management and digital payment. It is part of the governor’s commitment to ensuring transparency and accountability in public finance,” he stated.

Dr. Ladan explained that Katsina’s TSA officially took off in January 2024, following the work of a roadmap committee set up when Governor Radda assumed office in 2023. Dr. Ladan served as the committee’s secretary before being appointed the first Technical Adviser on TSA implementation in 2025.

He said the TSA rollout is being implemented in phases, beginning with ministries, departments, and non-informal revenue agencies. The current phase targets self-sustaining institutions that generate and spend revenue internally, such as tertiary institutions, hospitals, and the Katsina State Transport Authority (KSTA).

According to him, agencies like KSTA rely on immediate access to funds for fuel, repairs, and daily operations, and subjecting these expenditures to lengthy approvals could cripple essential services.

“We are deploying a system that works for self-sustaining agencies without compromising TSA policy or disrupting their operational mandate,” he said.

The training is divided into three stages: TSA policy orientation, advanced technical sessions, and system monitoring using government financial platforms and payment gateways.

He added that by January 2026, all financial processes in the state—including payments, budgeting, and cash flow tracking—will be fully automated.

“When you receive money, it will reflect in the budget and affect cash flow. When you pay out, it will record as expenditure. The system will be seamless,” he said.

Dr. Ladan disclosed that self-sustaining agencies generated over ₦3 billion between September and November this year, much of which had never been properly captured in the state’s financial systems.

He noted that proper documentation boosts federal allocation, which partly depends on transparent Internally Generated Revenue (IGR) records.

“Money is a record. Without capturing revenue from self-sustaining agencies, the state reports ‘one’, but with their contribution, it becomes ‘one plus one’. That difference affects federal funding,” he said.

In his remarks, the State Accountant-General, Nura Talla, said integrating self-funding agencies into the TSA will enhance accountability and eliminate manual loopholes previously exploited in revenue handling.

He explained that the reform is designed to strengthen cash control, improve fiscal reporting, and stop agencies from running parallel accounts outside government oversight.

“This reform is not to restrict agencies, but to ensure every kobo is reflected in government records while still allowing them to function efficiently,” the Accountant-General said.