From Umar Danladi Ado, Sokoto

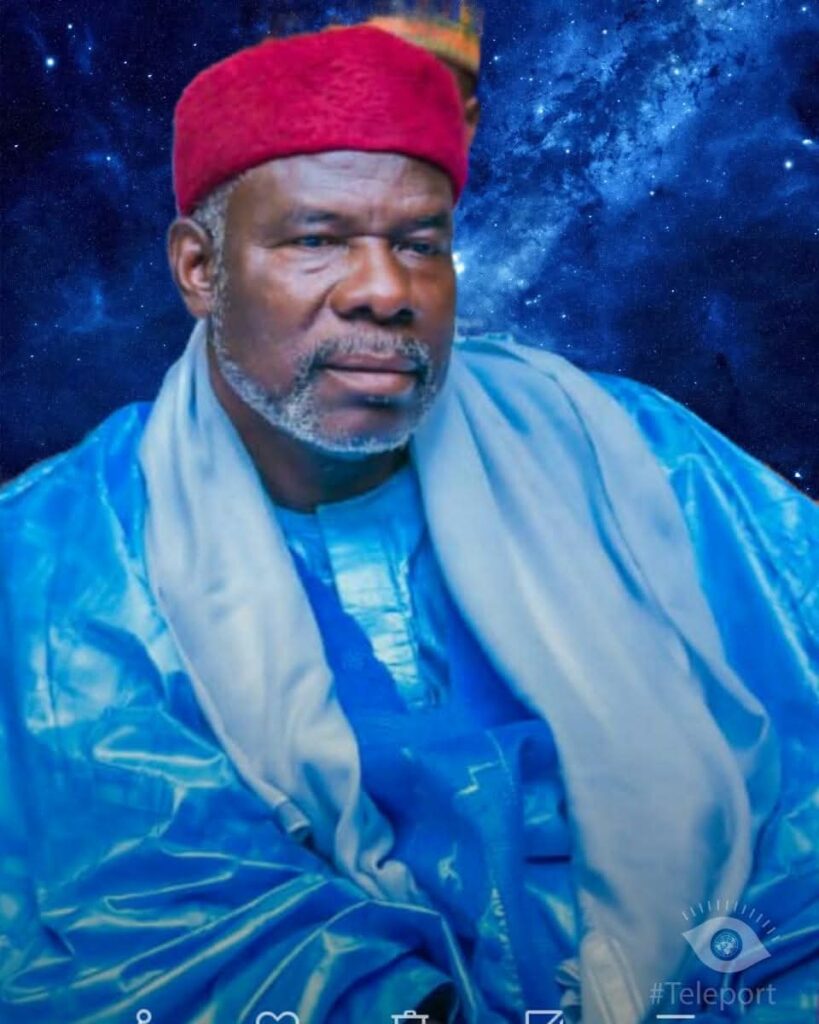

The Commissioner for Planning, Research, Statistics, Information and Library Services (PRSILS) at the National Hajj Commission of Nigeria (NAHCON), Prof. Abubakar Yagawal, has said the Hajj Savings Scheme (HSS) remains the most sustainable model for ensuring a smooth and well-organised Hajj operation for Nigerian pilgrims.

Yagawal stated this on Monday in Sokoto while speaking with newsmen on Nigeria’s preparations for the 2026 Hajj.

The scheme, introduced through a partnership between NAHCON and non-interest financial institutions—especially Jaiz Bank—allows intending pilgrims to save gradually in a Sharia-compliant system ahead of their pilgrimage.

Yagawal said the HSS was designed to eliminate the persistent late payment of Hajj fares, which often forces Nigerian pilgrims into last-minute arrangements that lead to poor accommodation and difficult logistics in Saudi Arabia.

“Most Nigerians wait until very close to the deadline fixed for payment. Some rush to sell livestock or farm produce and then pay at once or in two or three installments,” he said.

“This attitude affects proper planning in Nigeria because Saudi authorities operate strictly on a first-come, first-serve basis. They communicate plans for the next Hajj immediately after completing the current year’s rituals.”

According to him, the Hajj Savings Scheme—already practiced globally—helps countries plan years ahead, secure better accommodation in Mecca and Medina, and streamline all operational processes.

Yagawal said intending pilgrims can approach designated financial institutions offering the HSS platform and save in installments.

He explained that the deposits are invested through legitimate, non-interest transactions, allowing savers to earn lawful returns that can reduce the total Hajj fare.

“This is a legacy tool that will serve generations to come, especially our youth and low-income earners,” he stated.

The NAHCON official commended President Bola Ahmed Tinubu for his commitment to improving Hajj operations and ensuring a hitch-free exercise, including the recent reduction in Hajj fares for the 2026 pilgrimage.

He also applauded state governors, particularly those under the North-West Governors Forum, for supporting NAHCON and demonstrating readiness to comply with early payment timelines.

Yagawal appealed to all stakeholders to strictly adhere to the schedules issued by Saudi authorities for the 2026 Hajj.

According to newsmen, the Hajj Savings Scheme operates under the Mudaraba (partnership) principle, where deposits are invested and profits shared with savers, helping subsidise the cost of the pilgrimage.

The scheme is open to all Muslims regardless of age, income level or social status, with flexible payment options available—ranging from daily and weekly to monthly, quarterly or semi-annual contributions.